What can you afford?

Figure out what you can afford!!!

Buying a Home is a huge investment, and a person puts all his hard-earned money into it. You must know what you can afford looking at your future plan, liabilities, saving, and forecasted future income. YOU MUST KNOW YOUR BUDGET for buying a Home.

There are few things in life as disappointing as losing out on the home of your dreams due to not being able to secure funding. While the desire to get out to search for that great home is understandable, it is vital to line up the financing you will need before you start shopping for a home.

Getting the financing ahead of time has a number of important advantages, including knowing how much you can buy and gaining more respect from real estate agents. By knowing how much you can afford before you shop you will avoid wasting your time looking at unaffordable properties, and the real estate agent will be more than willing to show you the homes within your price range.

It is also important to take a good look at the various types of mortgages on the market before getting started in the home buying process. These days, mortgages come in far more choices than the typical 15 or 30 years. For that reason, potential home buyers need to understand how each type of mortgage works, and to gauge which mortgage is the best choice for their needs.

It is always recommended to get a pre-approved HOME LOAN. Being pre-approved not only confirms your budget but it also puts you in a stronger buying position. First, a bank reviews your application on the basis of Income & Liabilities and then issues a Pre-Sanction Letter stating that you are eligible for so and so amount of home loan, subject to property finalization. Setting up a Budget is a more crucial task in the Home Buying Process. Homebuyer should know the source of finance from where he will arrange his financial commitment to fulfil his home buying dream.

You should look at your finances in order to determine how much you can afford to spend on a home. Look at your income, assets and current debt level. You aren’t looking at what percentage the lender says you can afford; you are looking at what your finances dictate.

Don’t overlook other expenses, such as property taxes and Homebuyer insurance. Your total interest, principal, taxes and insurance payment, monthly debt, your mortgage, autos, student loans and credit cards.

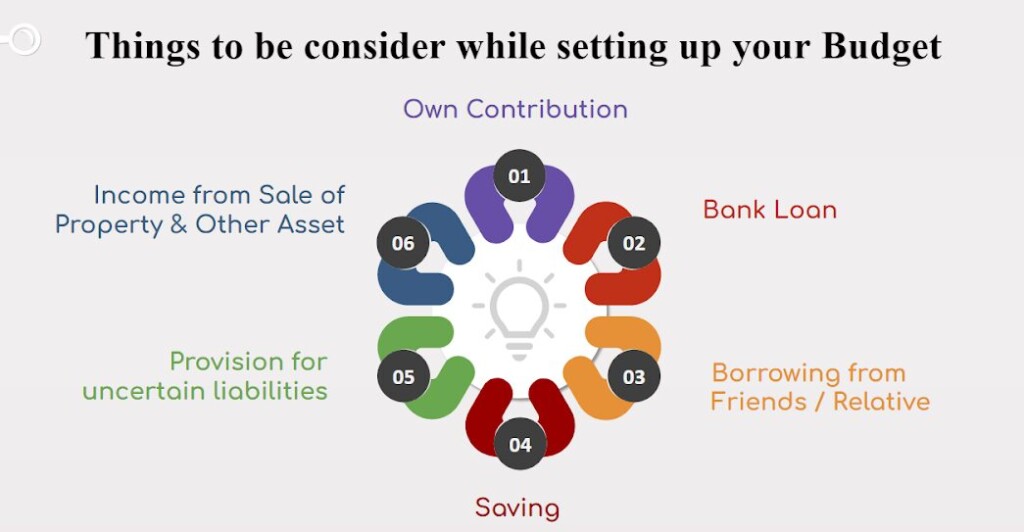

Things to be consider while setting up your Budget

- Own Contribution

- Bank Loan

- Borrowing from Friends / Relative

- Saving

- Provision for uncertain liabilities

- Income from Sale of Property & Other Asset

For property search fill out this form and get best offers and opportunities.